Updates relevant to the Mortgage Industry During the COVID19 Crisis

*Thank you to our friends at RateSPY and the Government sites for the data and reports

Mortgage Report July 01, 2020

—The Happy Canada Day Report: July 1—

- Fixed or Bust: Canada’s lowest nationally available conventional variable rate is just nine basis points cheaper than a comparable 5-year fixed rate. That minuscule “fixed-variable” spread is now 80% narrower than its 10-year average. In other words, the market is no longer compensating new borrowers for the risk of a floating-rate mortgage. And that may be a problem. Why? Because prime rate almost always climbs after a recession — even if only for a few years and even if only a limited amount. If, for example, the BoC hiked a modest 75 basis points like it did in 2010—today’s nine-basis-point variable-rate “advantage” would not be enough. In other words, you’d still pay less in a 5-year fixed. That’s true even if said rate hikes didn’t happen for the next four years. The message for mortgage shoppers: If you plan to ride out your mortgage for five full years with no changes, the math doesn’t look appealing for variables at today’s so-so discounts (from prime rate). Yes, rates could still fall, but it’s impossible to time the bottom, and today’s best fixed rates are just two points from free money.

Spy Tip: If you do opt for a 5-year fixed, pick a fair penalty lender unless you’re quoted an exceptional rate and there’s a low probability of breaking or refinancing the mortgage early. Otherwise, the risk of an interest rate differential penalty simply isn’t worth it.

- RBC Cuts: Big blue lowered a bunch of rates today:

- Special fixed rates:

- 1yr: 2.89% to 2.74%

- 2yr: 2.54% to 2.39%

- 3yr: 2.64% to 2.49%

- 4yr: 2.69% to 2.54%

- 5yr: 2.89% to 2.59%

- 7yr: 3.39% to 3.24%

- Special variable rate:

- 5yr closed: 2.40% to 2.25% (Prime – 0.20%)

- Special fixed rates:

- CIBC Cuts: The imperial bank has dropped two special fixed rates:

- 5yr fixed: 2.82% to 2.57%

- 7yr fixed: 3.07% to 2.99%

Banks are clearly getting more aggressive with 5-year fixed rates, and it’s about time. The lowest nationally available conventional 5-year rates have been 2.14% or less for weeks. Scotiabank’s eHOME site is quoting spectacular deals: as low as 2.10% for insurable purchases and 2.15% for uninsured purchases—even lower than Scotia offers through its own Home Financing Advisors and brokers.

- Lending Slowdown: Ontario mortgage transactions fell 8.3% year-over-year in May, says Teranet.

- Counterintuitive: “HELOC borrowing…plummeted at the fastest pace in recorded history in April, the last data point available,” says Scotiabank.

- G-D-Plunge: Our economy shrank in April with GDP plummeting a record 11.6%. Believe it or not, that was better than expected. With many investors expecting worse, bond yields were little changed.

Mortgage Report June 30, 2020

- Stress Test Fix Overdue: Ottawa was sensible to pause the mortgage stress test changes “given the marketplace uncertainty in March,” says Paul Taylor, President and CEO, Mortgage Professionals Canada. “However, as we begin to open businesses again, and as economists are generally expecting a housing price downturn, now is the time for OSFI and Finance to consider implementation of the new test.” He explains that: “Unsurprisingly to many in the industry, the large reductions in the Bank of Canada’s overnight rate are still not reflected in the Bank’s posted 5-year rate, and [at 250 basis points], this dislocation is well above [normal]….There is also no expectation of any material increase in interest rates for the foreseeable future.” As a result, Taylor says, “Continuing to pause the previously announced changes leaves in place an unnecessarily punitive, pro-cyclical and suppressive minimum qualification rate that is more than double the expected interest rate most borrowers would pay. To help minimize the expected [home] value reductions and erosion of millions of Canadians’ net worth, the announced change should be implemented before the mortgage deferral programs expire.”

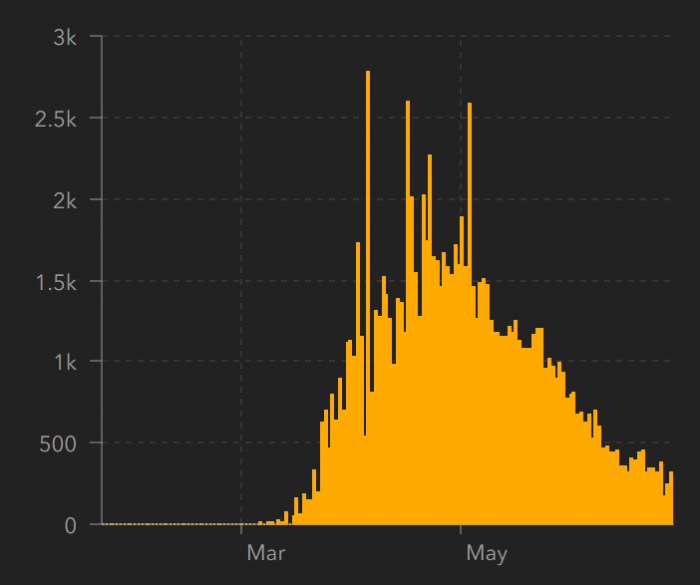

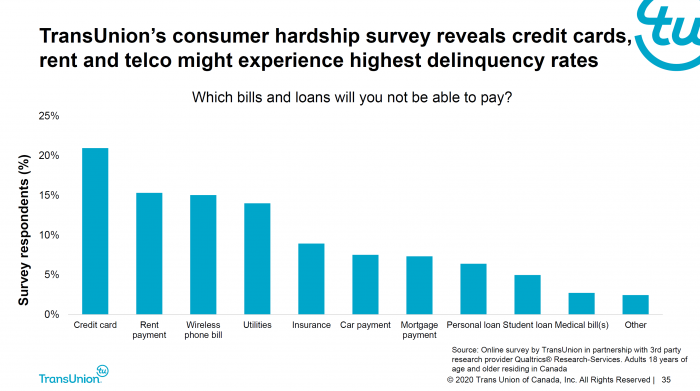

- “The Worst is Yet to Come”: So says the World Health Organization about the pandemic. And it’s our neighbour we have to worry about most.Witness the daily COVID cases in Canada:

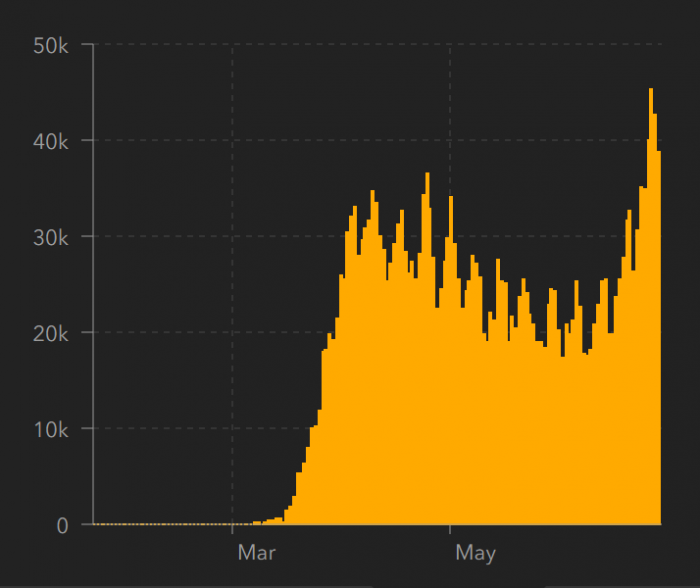

And the daily COVID cases in the U.S.:

Notwithstanding Canada’s relative success in containment, this unmistakable resurgence in U.S. cases—despite being linked to more widespread testing—is rate bearish for both countries.

- CMHC’s July 1 Rule Changes: Q&A on the New Mortgage Rules, via Rates.ca.

Mortgage Report June 28, 2020

Renewal Tax: Borrowers get worse deals on mortgage renewals than on brand new mortgages. And it’s been that way for decades. Interest rates on renewals have historically been about nine basis-points (0.09%) higher than rates on new mortgages. That’s based on a survey of five-year uninsured mortgages from 19 of the largest federally regulated lenders (source: OSFI). Less-aggressive rate shopping at renewal explains part of this “renewal tax.” Most borrowers settle for higher rates simply to avoid the inconvenience of switching lenders. And lenders know that. Interestingly, the rate differential as of January was double the normal spread at 18 bps, says OSFI. That means $1,200+ more interest over five years on a $300,000 mortgage. Part of this increase may be due to OSFI’s failure to afford a “stress test” exemption to renewers wanting to switch lenders for a better deal. That has effectively trapped a small percentage of borrowers at their existing lender, compelling them to pay higher rates. (OSFI exempts lenders from having to apply the stress test to existing borrowers who simply renew.) To date, the regulator has refused to address this problem, saying there’s no evidence of “significantly higher” rates for renewers since the stress test began. Its idea of “significant” is apparently different from others. In any event, OSFI has told us in the past that the data it relied on to draw this conclusion doesn’t break down renewal rates by borrower qualifications. So there’s no way to tell if people with higher debt ratios (who are less able to pass the stress test) are now getting worse rates, relative to other borrowers. The regulator’s data is therefore largely inconclusive.

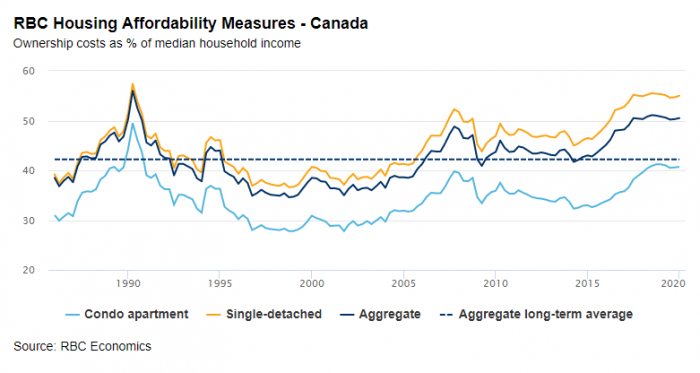

- Affordability Strain: “Ontario was the only province where affordability deteriorated last quarter,” reports RBC. And don’t be surprised if “economic hardship causes potential buyers (especially first-time buyers) to delay their purchasing plans, and financially-strained owners (including investors) sell their property once support programs run out,” the bank says. “We believe the scale will tip in favour of buyers in many markets across Canada and (benchmark) prices will fall modestly, possibly as early as this summer.”

- Stressful Pre-approvals: Here’s a tale about pre-approvals. The story leaves out important details but conveys three good lessons: (1) don’t expect fast response times from lenders with the lowest rates; (2) allow plenty of time to arrange financing on a home purchase; and (3) pre-approvals sometimes aren’t worth the paper they’re written on.

- Branch Casualties: COVID has “accelerated” HSBC’s move away from branch banking. The world’s sixth-largest bank is slashing 35,000 jobs globally. Canadians have seen the fruits of its online push already with HSBC advertising some of the most aggressive nationally available mortgage rates since 2017. Each quarter that our Big Six banks fail to aggressively counter HSBC’s online mortgage push is another quarter banks give up share to this threat that is the Hongkong and Shanghai Banking Corporation. Fintechs who think they’ll dominate e-lending should also be put on notice. Massive banks can pivot into online mortgage origination faster than they think, and mega-banks have far lower funding costs. HSBC epitomizes both points.

- Cooling Market: Economists’ home price estimates have fallen at least 3% since March, according to a Reuters poll. Given the severity of this recession, that implies a much softer landing than many had feared.

- Quotable: “The experience of Japan over the past 25 years provides a compelling counter-argument to those who believe that the huge injection of monetary stimulus in other developed economies in recent months will inevitably lead to a jump in inflation.”— By Neil Shearing, Chief Economist, Capital Economics

Mortgage Report June 26, 2020

- OSFI Unplugged: Alberta MP Tom Kmiec has obtained internal emails from OSFI that chronicle the regulator’s efforts to improve the mortgage stress test—in particular its efforts to “fix” the minimum qualifying rate (a.k.a., “MQR” or benchmark rate). The emails show that OSFI’s PR staff wanted the public to know it was making “efforts to get it right.” That’s despite OSFI’s opinion that Canada’s stress test is already “less stringent” than countries like the UK and Australia. The regulator nevertheless admitted the MQR was “no longer working as intended” since banks were keeping posted rates abnormally high. OSFI decided to set a more realistic MQR and said it wanted to communicate its improvements “in advance of the spring housing market.” It eventually did that—choosing an April 6 effective date—only to later suspend this essential stress test fix, blaming COVID. With the spring housing market starting late this year and home prices at risk, many in the real estate sector believe OSFI needs to announce a new implementation date soon.

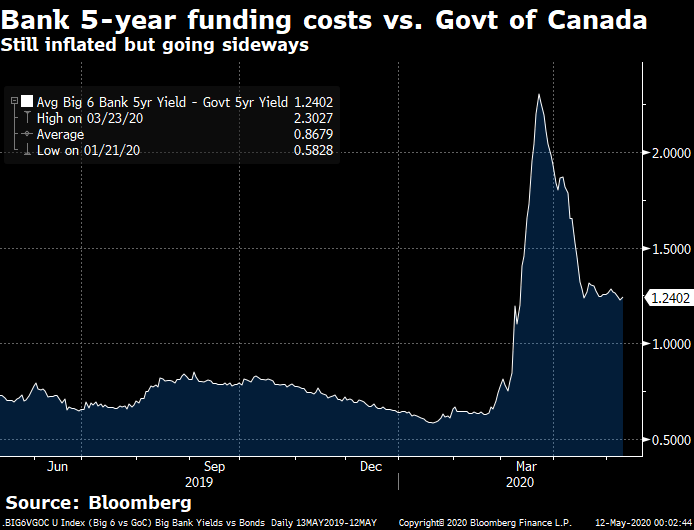

- Laggards Gain on the Leaders: At the height of the C-Virus panic in March, Big 6 banks were 63 bps less competitive than the leading national lender.* Normal over the last five years has been about 24 bps. Today, however, major banks are 33 bps less competitive than the lowest nationally available 5-year fixed rate. So, things are improving. This partly reflects the easing of big-bank funding costs. Barring another COVID blowup or default spike, those funding costs could be back near normal in roughly two to three months. *Source: RateSpy.com’s Big Bank discretionary rate estimates

- TD Cuts: Canada’s second-largest bank lowered these special rates today:

- 3yr fixed: 2.64% to 2.54%

- 5yr fixed: 2.82% to 2.57%

- 25 bps is an abnormally big drop all at once

- 5-15 bps is more typical

- TD is clearly feeling more pressure to win market share

- 5yr fixed (high ratio): 2.59% to 2.37%

- 5yr variable: 2.35% to 2.20% (benchmark prime – 0.25)

- Necessary Penalty: Here’s an example of when you should pay a mortgage penalty to get a better rate, via Rates.ca.

- CMHC Predicts Home Prices: Here are some of the housing agency’s latest price-growth forecasts over the next two years:

- Calgary: -11%

- Edmonton: -11%

- Montreal: +5%

- Ottawa: +1%

- Toronto: 0%

- Vancouver: -6%

Note: These figures reflect a simple average of CMHC’s optimistic and pessimistic projections.

- Can You Get Approved While on CERB?: CTV’s Pattie Lovett-Reid answers the question.

- Predicted Lower: Mortgage analysts on a Bloomberg panel this week predicted U.S. fixed mortgage rates will drop about another 1/4-percentage point, even if government yields remain the same. If that happens, Canadian rates would likely drift lower as well.

- Quotable: “…Use of the [mortgage] qualifying test becomes even more important in a low-rate environment as this is when borrowers end up stretching themselves by taking their debt servicing to their maximums.”—Robert Dougall, Managing Director, Credit Risk Division, OSFI, in a Jan. 15, 2020, internal memo

Mortgage Report June 25, 2020

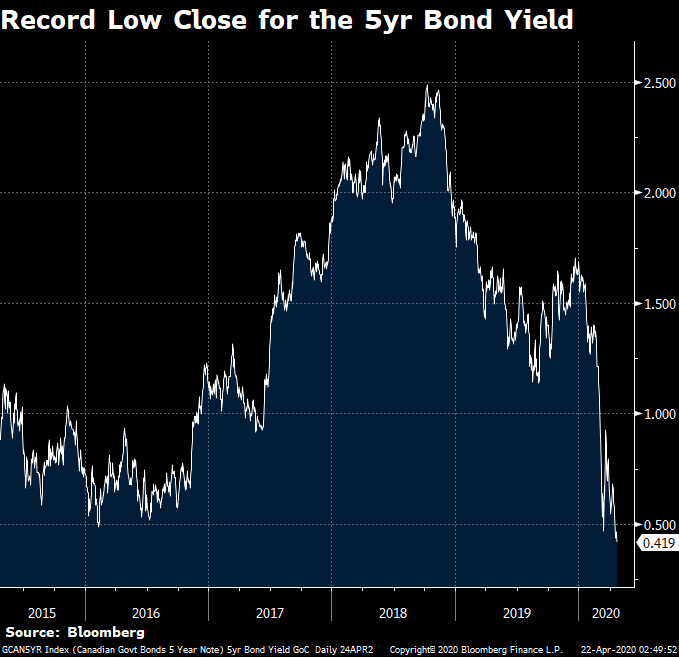

- We Just Got Downgraded: The government is spending too much and it’s caught up with them. Our record quarter-trillion deficit worried Fitch, a ratings firm, enough to cut Canada’s credit rating today. “Pandemic lockdown measures and depressed global oil demand will cause a severe recession of the Canadian economy,” it says. Fitch projects Canada’s consolidated gross general government debt will soar to 115.1% of GDP in 2020, from 88.3% of GDP in 2019. Loss of our AAA rating implies incrementally higher risk of default, so investors could demand higher interest rates on Canadian debt. That would theoretically boost borrowing costs over time. As we speak, however, the 5-year bond yield is down since the news broke. It’s hard to say how much of that is thanks to the Bank of Canada, which has been buying billions of dollars of bonds for weeks. (Bond buying raises bond prices, other things equal. That lowers interest rates, since prices and yields move inversely.) At the end of the day, this news doesn’t change Canada’s outlook significantly. The U.S. is a case study. It lost its perfect AAA bond rating in 2011 and never got it back. Since then, U.S. 5-year rates have dropped 76 bps. There are clearly greater forces are at play than credit ratings. Thankfully for now, there’s no adverse impact on Canadian yields, and hence no current effect on mortgage rates.

Mortgage Report June 24, 2020

- Prices Will Fall, Unless They Don’t: “Short-term uncertainty will lead to severe declines in sales activity and in new construction,” CMHC reported Tuesday. “House prices will fall as well and are unlikely to recover over the horizon of this report (through 2022).” But that statement is a tad general. It would be a mistake to think prices must fall everywhere. It’s also a question of when prices will drop, and for how long. If interim data from home-price tracker HouseSigma is indicative, there’s an outside chance median GTA home prices could hit a record in June. Who would’ve thought that when the &#!+ hit the fan in March? CMHC expects “resale sales and prices to rebound in 2022,” but admits it can’t accurately forecast with so many unknowns. Its deputy economist says we might need to “wait another six months or more to see definitive trends.” It’ll take even longer to know if CMHC’s now-infamous prediction of a 9% to 18% home price slide is on the mark.

- Another Mortgage First: Never before have Canada’s lowest variable, 1-year, 2-year, 3-year, 4-year and 5-year fixed rates all been under 2%…until today. For now, these rates apply to insured mortgages only. And no, there are no nationally available uninsured rates under 2% yet. But this is a start.

- It’s Time to Free FICO 8: There’s a problem with the current crop of free credit score providers. The scores they give you are sometimes over 50 points different from the scores mortgage lenders see. That’s a serious problem for some mortgage shoppers because it sets misleading expectations. Someone may see their “free” score as 650, for example, only to learn their lender-obtained score is in the high 500s, preventing them from qualifying for cost-effective financing with a prime lender. Free score providers don’t advertise this fault. Worse yet, lenders use too many different scores. There’s no dominant industry standard. Some use “ERS” scores (Equifax’s proprietary score), some use “CreditVision” scores (TransUnion’s proprietary score), some use FICO 4, some use FICO 8 and so on. The closest thing to a mortgage standard is arguably the FICO 8. It includes mortgage accounts and cell provider accounts (some scores don’t), it’s a score commonly used by mortgage brokers and it’s adopted by numerous lenders. Unfortunately, nobody offers it to consumers, despite it being available for licensing. It’s time for that to change. It’s time for companies hawking partly useful free scores (the Mogos, Borrowells and Credit Karmas of the world) to offer a more practical score. For mortgage purposes, FICO 8 is best of breed.

- BFS Tip: If you’re business-for-self (what lenders call self-employed people), lenders let you to “gross up” your income. That means they’ll assume you earn at least 15% more than the business income reported on your tax returns. They do this to streamline applications, because they know entrepreneurs have multiple deductions and generally make more than their declared income. Most lenders allow gross-ups only for non-incorporated entrepreneurs. But some prime lenders will even gross-up an incorporated self-employed borrower’s income. So long as it’s a small company with 1 – 4 shareholders. These policies apply whether the mortgage is default-insured or uninsured. If you’re self-employed and want to know which lender is most flexible with income inclusion, call an experienced mortgage broker.

- The #1 Arrears Indicator: “Mortgage arrears are based on employment, so employment is a key indicator for us” — Thomas Kim, VP of Capital Markets at First National.

Mortgage Report June 23, 2020

By The Spy on June 22, 2020

- Just the Latest Head-Turning Rate: What would a week be without a new low in mortgage rates? The latest term to wear the low-rate crown is the 1-year fixed, thanks to a new promo available through deep-discount brokers. Priced at 1.69%, it’s the cheapest effective rate on a 12-month mortgage since 2016. It’s also officially the lowest rate we’re tracking in Canada. Of course, people don’t usually line up for 1-year terms. Most prefer to avoid the hassle and minor expense of renewing in 12 months. But, for those who want financing to fill the gap until aggressive variable-rate discounts return, a 1-year fits the bill. (For background: Variable-rate discounts were prime – 1.00% and better as of early March. They’ve since deteriorated to prime – 0.70%, at best.) This deal has strings attached, however. It applies only to default-insured purchases and insurable purchases with 35% or more equity. If you’re interested, here are all the best 1-year fixed rate offers on the market.

- Tiff Speaks: Freshman BoC Governor Tiff Macklem made his first in-public speech today. Here were some takeaways for mortgage consumers (the Spy’s comments in italics):

- “If, as we expect, supply is restored more quickly than demand, this could lead to a large gap between the two, putting a lot of downward pressure on inflation. Rate Impact: Bearish

- “Some central banks have taken their policy rates below zero. We feel that bringing that rate into negative territory could lead to distortions in the behaviour of financial institutions.” Rate Impact: Minimal

- “The Bank has committed to buying at least $5 billion of Canadian government bonds a week until the recovery is well underway.” Rate Impact: Bearish, For Now

- “Quantitative easing can…send a signal that our policy interest rate is likely to remain low for a long period.” It’s sending that signal as we speak.

- “The pandemic is likely to inflict some lasting damage to demand and supply.” Rate Impact: Bearish Longer-term

- Real Estate Supply Ahead: RBC: “The delay in spring listings will likely boost supply during the summer at a time when homebuyer demand will still be soft—albeit recovering,” wrote RBC last week. “The eventual winding down of financial support programs is also poised to bring more supply to market later this year.”

- Quotable: “If you think that the economy did hit bottom in April, a rate hike in two years … is a plausible outcome I think”— Andrew Kelvin, chief Canada strategist at TD Securities, via Reuters

Mortgage Report June 20, 2020

- Long-term Money on Sale: If you’re willing to commit to a decade-long term, and you live in Ontario, you can now do it for less than at any time in history. 10-year fixed rates are now as low as 2.79% (an effective rate including cash back) for well-qualified borrowers in Ontario. Outside of Ontario, you’re looking at 2.84%. These rates are available on all loan-to-values. Refis too. Just beware: the penalty can be ugly if you break a 10-year before five years. Once you’re five years in, the prepayment charge is just three-months’ interest. These rates will appeal to only a small single-digit percentage of risk-averse borrowers, however. With 5-year fixed rates selling for half a point less, few will make the bet that:

a) inflation and interest rates surge by 2025

b) 10-year fixed rates are worth the extra $2,347 (per $100,000 of loan balance) interest premium in the first five years.

- Renewal Gambit: Your lender may very well call your bluff when you’re trying to negotiate your renewal rate. If you’re well-qualified, let it. More on that from Rates.ca.

- Steady as She Goes: Bond yields barely budged this week. That means yet another week where fixed rates didn’t increase. In fact, quite the opposite. Fixed mortgages are still slowly getting cheaper as lenders eat into their profit margins. Those margins inflated to supersized-proportions after the brief March funding panic died down. Hence, there’s still a little more room for rate discounting, even if bond yields do nothing all summer (which they won’t).

- Pessimist, Alarmist or Realist?: Canada’s housing agency CEO clearly isn’t paid to be a housing cheerleader. In a tweet this week, he suggested people not get excited by the rebound in home sales.

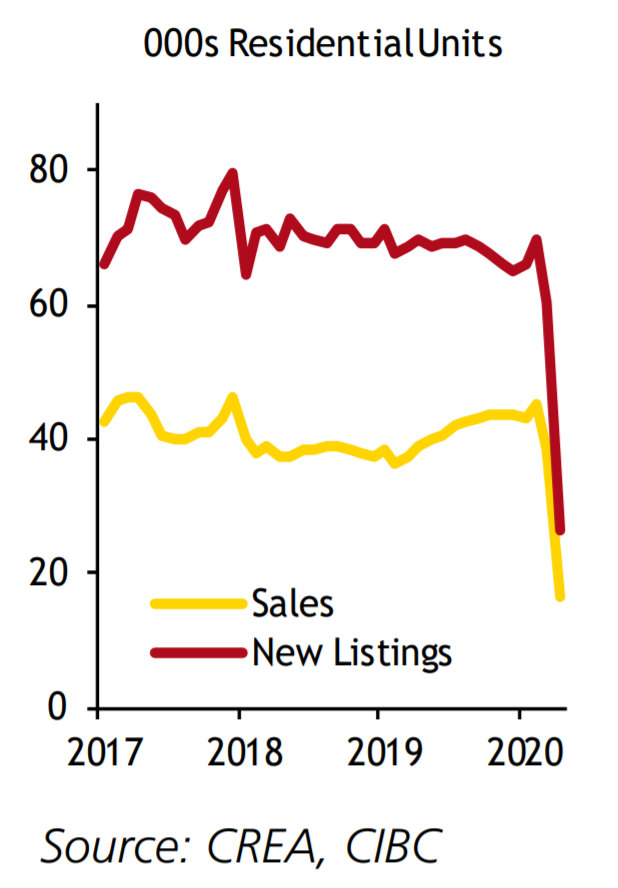

- Explosion of Listings: The record 69% surge in new real estate listings “could reflect homeowners that have lost their jobs being forced to sell,” says Capital Economics. “Equally, however, it could be that the sudden re-start in economic activity was always likely to result in new listings rebounding ahead of sales.”

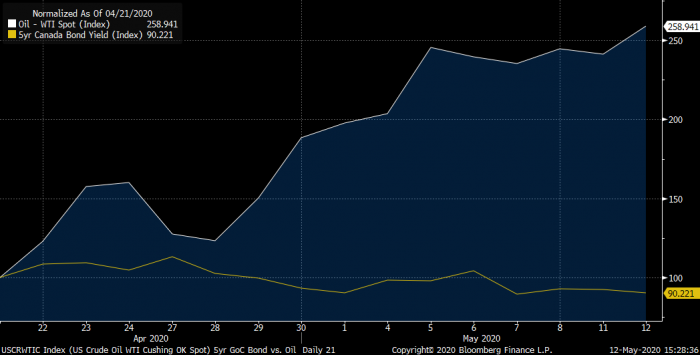

- No Slippery Slope: Oil’s been doing a moonshot ever since the April lows. Today, crude reached its highest point ($40.49 a barrel for WTI) since the price war started in March. That matters for rates given how vital oil—a key Canadian export—is to GDP. Yet, bond yields aren’t responding, as the below chart of oil vs. the 5-year yield shows. That’s curious given the positive correlation between the two over the last decade. If the market isn’t taking as many cues from oil, it suggests a surge in oil prices could entail less risk of higher mortgage rates than it used to.

Mortgage Report June 19, 2020

For Better or Worse: When you take a bank’s 5-year fixed you’re married to it for half a decade. That is, unless you file for divorce, so to speak (i.e., discharge or transfer the mortgage to a new lender early). But as unwedded people find out, splitting up has a financial price. When you break up with your bank before maturity, that price is called a penalty. Here’s a story from Dave Larock on how much breaking up with HSBC early could cost if you take its 1.99% 5-year fixed rate. Note: We haven’t verified Larock’s numbers, but the message is generally valid. Name-brand banks often have hideous prepayment charges on fixed-rate mortgages. It’s a topic we and countless others have almost beat to death. And yet, a majority of borrowers still lock in with such lenders despite similar or better rates elsewhere. Penalties are a risk for the almost half of borrowers who don’t make it through a full five-year term before renegotiating or breaking their mortgage. Fortunately for customers in most provinces, even lower 5-year fixed rates than 1.99% exist from “fair penalty lenders.” You can find them from every deep-discount online mortgage broker on this website.

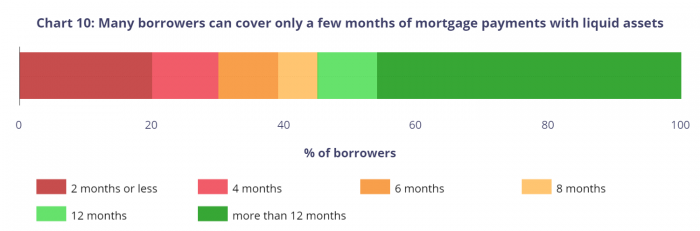

- Living on the Edge: “About 20 percent of all mortgage borrowers do not have enough liquid assets to cover two months of mortgage payments,” says the Bank of Canada.

- National Bank Predicts: “…Declines in home prices lie ahead” (Globe story)

Mortgage Report June 18, 2020

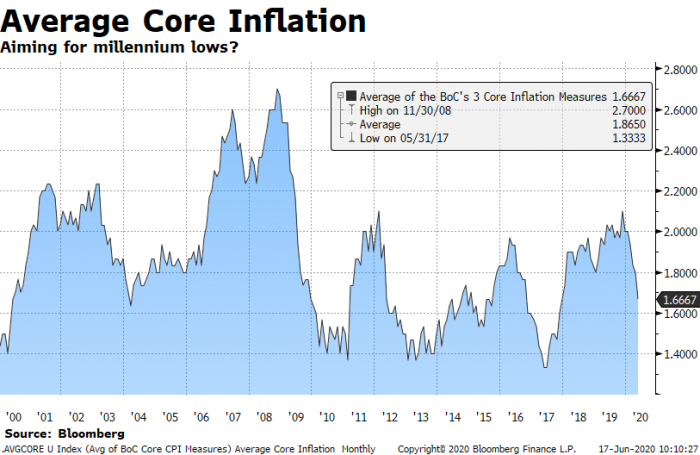

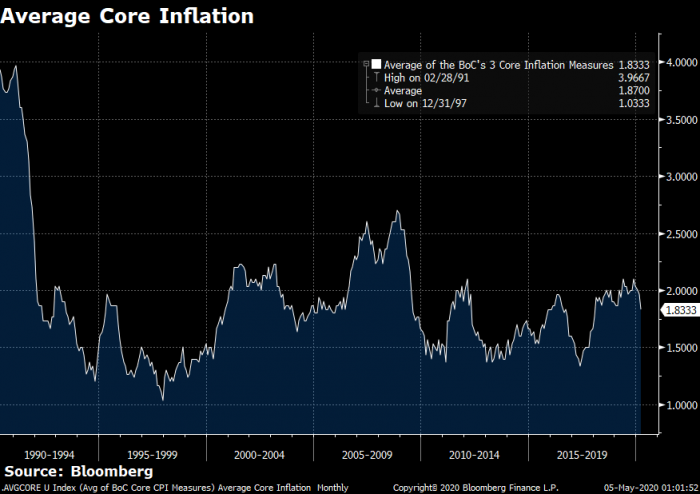

- Prices Slide: The Bank of Canada wants average core inflation at/near 2%, but it’s currently 1.67% and diving. That’s noteworthy for borrowers given inflation expectations are a primary determinant of mortgage rates. Inflation’s descent may slow thanks to rebounding oil prices, but it’ll continue dropping economists say—potentially to lows we haven’t seen in a few decades. Of course, what’s happening now is less important for rates than what’ll happen next year, and the year after. In a research note, CIBC said it has yet to speak to an investor that thinks Canada will emerge from recession faster than in 2009. At a minimum, it usually takes a couple years for inflation to rebound meaningfully above 2% following a recession, but with record unemployment this time, it could take longer. Two percent inflation is hard enough to sustain in an old economy facing over-indebtedness, an ageing population, technology-driven disinflation, etc.—let alone in a recession-ravaged economy where more than 10% of workers could remain unemployed or under-employed for years.

- Liberal Debt Ratios: Brokers now have new options for people with high debt ratios. Whereas 44% is the typical industry limit for a borrower’s total debt service ratio (i.e., the ratio of your monthly obligations to your monthly gross income), some lenders now advertise up to 60%. That may sound crazy, but high debt ratios on paper don’t always mean a borrower is a high risk. Lenders won’t lend a dime if they don’t think they’ll get their money back. No institutional lender wants to take someone’s house. These 60% TDS products are aimed at people who are a reasonable credit risk, people who have:

- 35-40% equity

- or as little as 20% on exception, for those with great credit

- proof of income to make their payments

- albeit, the borrower might have an insufficient long-term track record of income

- this could include someone who had income interruption but is back on the job, or who recently started a new business and doesn’t have the standard 2-year income history that lenders typically want

- temporarily high debt ratios

- the borrower may have a big monthly payment ending soon, an inheritance on the way, a deal closing that will generate a windfall, another property being sold, or some other event that will reduce total debt ratios.

- a marketable property in a liquid housing market

- Lenders usually have no appetite to lend at 60% TDS in small towns, or on subpar properties (e.g., a house next to a gas station or cemetary)

- satisfactory credit

- e.g. a FICO score in the 600s or higher (people with lots of equity usually have good credit)

- 35-40% equity

These 60% TDS products most often come with 1-year terms and rates in the high 3s to high 4s, plus a 1% lender fee. They’re typically available for purchases and refinances of owner-occupied properties. If you’ve had short-term financial or employment issues that are now corrected, and you can’t get approved by a bank because of a temporarily inflated debt load, a broker experienced in alternative lending may be the answer.

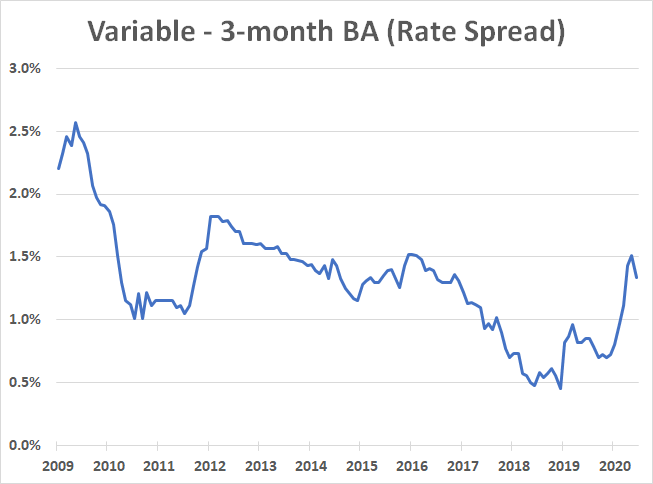

- Room to Improve: Variable rates for new borrowers will get better, even if prime rate doesn’t fall anymore. The reason: lenders’ costs have fallen after spiking during the COVID crisis. As a result, lenders have profit margin to play with. The chart below is a crude representation of that margin. It shows the difference between the lowest nationally-available variable rate minus the 3-month bankers’ acceptance yield (which is a rough proxy for a lender’s base variable-rate funding costs). If mortgage defaults don’t surge, this spread should drift closer to 1.00% before too long. When that happens, assuming prime rate stays constant, we’ll see Canada’s lowest variable rates improve. Barring the unexpected, there’s a good chance we could even see prime – 0.90% (1.55%) or better by the end of this year. (Note: None of this impacts the rates paid by existing floating-rate borrowers.)

Mortgage Report June 17, 2020

- Tiff on the Hot Seat: In his first news public hearing since being minted as BoC Governor, Tiff Macklem got pelted with questions from MPs. Among his notable statements:

- “The biggest risk to Canadians not being able to repay their mortgage is not having a job.”

- “…We’re in a deep hole and it’s going to be a long way out of this hole.”

- “We have no intention of raising interest rates in the current circumstance.”

- “Some day we will get through this…and interest rates will start to move back to more normal levels.”

As long-time central bank watchers know, “some day” sometimes never comes. Case in point: Despite repeated messaging from the BoC that rates would ultimately “normalize” following the Global Financial Crisis, Canada’s overnight rate peaked only 1.50 percentage points above its record low—far below the Bank’s published definition of “normal.” There is currently no reason to believe this recovery will happen much faster.

- Flat as a Board: That’s how the consensus forecast for Canada’s overnight rate looks, all the way out to 2022 (the furthest out the survey goes). Economists’ median prediction is that Canada’s key lending rate will not move through third quarter 2022. Source: Bloomberg survey.

- April Strong: Canadian mortgage balances at domestic banks rose 6.7% year-over-year in April, according to OSFI data. Reverse mortgage volumes surged 21.3% as rates hit record lows. Here’s a breakdown that OSFI provided us today (rounded):

- Balance for all Residential Mortgages: $1.261 billion

- Residential Insured: $475 billion

- Residential Uninsured: $782 billion

- Residential Reverse Mortgages: $3.6 billion

- A Clue from Down South: Mortgage applications for purchases climbed for the eighth consecutive week in the U.S. They’re now near an 11-year high. That’s a good reminder that despite all the economic carnage, homebuying interest is far from moribund. One difference in the U.S., however, is that their qualifying rate has steadily dropped and is now below 3% in some cases. That fuels buying power. Canada’s qualifying rate (“stress test rate“) has barely moved and remains inflated at 4.94%.

- Big Buyer: Lower 5-year bond yields usually mean lower 5-year fixed mortgage rates. That’s why fixed-rate shoppers may be happy to hear this: “We have committed to continue purchases of Government of Canada bonds until the economic recovery is well underway,” said the BoC’s Governor. The Bank will be buying 5-year bonds next on June 25 and July 3. CIBC says that’s essential because “the last thing the BoC wants to see is…a climb in 5-year mortgage rates before the economy needs it.” As we speak, economists forecast a roughly 68-bps rise in the 5-year yield by fourth quarter 2022.* But they may be underestimating the BoC’s resolve to suppress all key rates.

- Quotable: “…Negative interest rates, are essentially a tax on the financial system,” writes First Trust Advisors, “and tend to embed expectations of weak GDP growth in the countries that have tried them” — two reasons the BoC rejects them.

Mortgage Report June 16, 2020

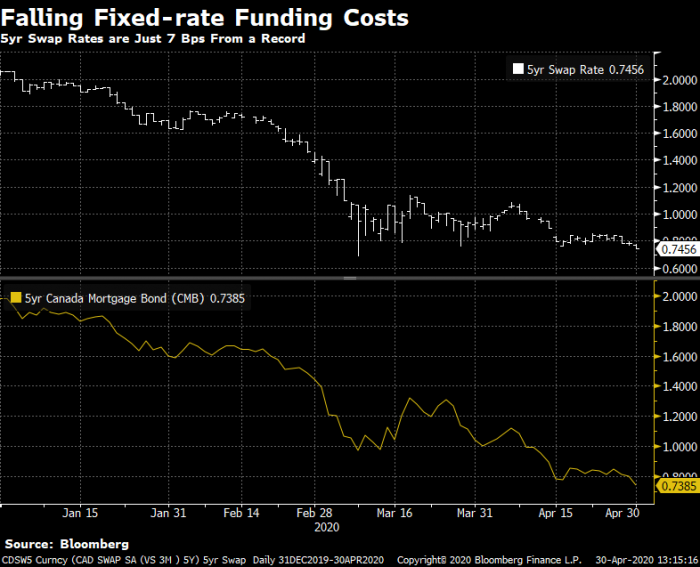

- Double-dip: As is often the case, bad news for the economy is good news for interest costs. Investor worries over a potential second wave of COVID-related shutdowns helped push 5-year Canada Mortgage Bond (CMB) yields to an all-time low on Monday. Recent Bank of Canada buying might have also helped. The reason this matters is because lenders use government-backed CMBs, a form of securitization, to cheaply fund mortgages. Lower yields coincided with a fresh all-time low for 5-year fixed rates: 1.90%. That’s an effective rate, including cash back, and it has caveats. Among other things, it’s limited to high-ratio purchases closing in 45 days in certain provinces. Nonetheless, it’s a hint that uninsured rates could also edge lower, barring any blockbuster vaccine news.

- Hit-and-Run: After just 10 days, HSBC has pulled its 1.75% insured variable-rate offer. The bank replaced it with a 2.14% 5-year fixed rate — which applies to switches from another lender that close within 60 days. No word on why HSBC yanked its variable promo so fast, but a handful of brokers are still offering a similar deal (prime – 0.70%) on an effective rate basis.

- Almost a Nothing-burger: “It is a peculiar time [for CMHC] to put the brakes on [housing],” says Royal LePage’s CEO. Fortunately, CIBC estimates CMHC’s insured rule-tightening will only impact 3-4% of mortgage originations.

- Real Estate Awakens: Listings surged by a record 69% in May. The national average home price rose slightly from April and dropped modestly (2.6%) versus a year ago. Thanks to surging sales, months of inventory sank from 9.05 in April to 6.64 in May, which is about 8% above the 10-year average. Despite the pop, sales were the lowest since 1996.

- Mind Those Pre-Approvals: “Ensuring that you have an up-to-date pre-approval is very important,” in this market, cautions Jason Davenport, Branch Manager at Meridian Credit Union. “If you have one from Pre-COVID, I would not assume it is still good.” He suggests paying special attention if you:

- Have a down payment from borrowed funds for a rental property. (“That used to be fine. Now, a lot of lenders are no longer accepting it,” he says.)

- Got your pre-approval based on self-employment income, overtime or bonus income (which may be heavily scrutinized because of tighter internal lending guidelines).

- Are currently receiving CERB (because you will likely not be approved at most lenders, he says).

- Harder Hit: Some say “Canadians with short credit histories, like millennials and new immigrants – two economically important groups – will be unduly disadvantaged by the changes.” Canada’s biggest non-bank lender correctly notes that for those “who are trying to establish themselves in a new country” a low score often “has nothing to do with their credit-worthiness.”

- Soft Rental Market: A shrinking pool of potential renters and new supply from AirBNBers are contributing to lower rents. But the effect should be temporary, lasting perhaps quarters but not several years. Rents could turn back up, as they did in much of the U.S. soon after the Great Recession, as:

- people get back to work

- some would-be buyers shift to rentals (because they can’t qualify for a mortgage, or don’t want one – if home prices weaken)

- immigration ramps back up

- travel resumes and alleviates pressure on Airbnb landlords.

- Fun Fact: 90% of deferred mortgages have a credit score over 680 (the typical minimum required to get the best rates). Source: CIBC

Mortgage Report June 15, 2020

Mortgage Deferral Warnings

Mortgage deferrals are appearing on Credit Reports – the credit reporting agencies are alerting lenders who you have requested a payment deferral. If you have deferred your mortgage, Equifax says you should see one or both of these statements in the comments section of your credit report:

Deferred Payment

Affected by Natural or Declared Disaster

Deferrals are not supposed to hurt your credit score. But, if they are being reported, a mainstream lender is going to see it and undoubtedly is going to be a red flag, leading to the lender perhaps

- looking over your income/employment more closely

- Asking for further clarification and documentation

- They may even decline your application if your qualification was borderline. Lenders issue different risk to different jobs depending on industry, and if it is a higher-risk industry, this is something that can likely occur.

Be prepared: You should disclose up front if you had a deferral. Mention this when applying. Lenders do not like surprises, and if you mention this ahead of time, it may make a difference, especially if you have a good explanation as to why needed a deferral and why your job is now stable over the long term.

It will definitely help if you can prove your income and employment are back to normal with documentation. If you are salaried, you will need a recent pay stub from the last 15 days or so. If you are self-employed, if you can prove with receipts or contracts that you are generating business revenue, and if you can back these up with bank statements, even better. If you are commissioned, if you have a recent commission statement and a bank statement, this will help your cause as well.

The most important thing, a lender is going to want to see you resuming making your payments, until you do so, it is unlikely that your application will be approved.

Lenders that Are not Using the Stress Test

There are multiple institutional lenders now advertising “less stress” mortgages where you don’t have to qualify at the bank’s qualifying rate. You only have to prove you can afford a payment based on your actual mortgage rate. These lenders can offer this flexibility because they’re not federally regulated.

Rates for such products start at roughly 3.49%, more than a point above the best available uninsured rates. That surcharge buys you more purchasing power. A household making $80,000 a year can get approved for roughly 15% more home (about $73,000 more buying power). One downside is the interest cost. A five-year rate of 3.49% vs. 2.49% costs you $18,729 more interest over 60 months on the average-priced ($488,203) home, assuming a 30-year amortization. That may sound like too high a price to pay until you factor in home price appreciation. If your home appreciates at the current 1.8% rate of annual core inflation, that’s a $45,549 gain over five years on the average priced home, two-and-a-half times the extra interest expense. To qualify for one of these “less stress” mortgages, you’ll need strong credit, fully provable income and 20%+ equity.

A “Recent Bank of Canada analysis suggested expiry of deferrals and income-support programs later this year—when the labour market still hasn’t fully healed from the COVID-19 shock—will push mortgage arrears higher in early 2021.”—RBC Economics

Mortgage Report June 10, 2020

More Rate Cuts. The FED announced that they will not even think about increasing rates until mid 2022.

Banks continue to slash their rates…..

Mortgage Report June 8, 2020

- Genworth Canada saw no need to follow CMHC and tighten its mortgage rules. Canada Guaranty, which has the lowest loss ratio in the mortgage insurance industry, made the same determination, saying, “Given implementation of the qualifying stress test and historic default patterns, Canada Guaranty does not anticipate borrower debt-service ratios at time of origination to be a significant predictor of mortgage defaults.”

- CMHC is not banning all borrowed down payments. It will still allow down payment funds that originate from:

- A loan from one’s own RRSP (using the Home Buyers Plan).

- A HELOC on another property that the borrower owns.

- A HELOC on a property their parents own (if the parents gift those funds to the borrower).

- Note: CMHC will no longer allow down payment funds from unsecured borrowing. That includes from a HELOC on a property the borrower’s parents own — if the parents loan those funds to the borrower.

CMHC adds that “eligible traditional sources of down payment may include: savings, the sale of a property, non-repayable financial gift from a relative, funds borrowed against their liquid financial assets, funds borrowed against their real property, or a government grant.”

- Note: CMHC will no longer allow down payment funds from unsecured borrowing. That includes from a HELOC on a property the borrower’s parents own — if the parents loan those funds to the borrower.

- It’s Now Official: Our neighbour to the south is in recession.

- Double the Deferrals: Canada’ has nearly twice as many people deferring mortgage payments than the U.S.

- More Rate Cuts: Banks continue to lower their rates

- Record Home Prices?: It’s almost like GTA home prices are taking their cues from the stock market. If HouseSigma’s estimate is right and the trend continues, GTA home values could potentially set a record in June.

- As Expected: As the pandemic began taking a toll on incomes in March, people tapped their HELOCs at a faster clip.

- Fully Reversed: Rates on reverse mortgages sprang up in April, but now every single reverse mortgage rate in Canada is below 5% — for the first time ever.

- Mortgage Business is very busy: Despite all the headwinds from online competitors, banks, a slowing economy and mortgage regulations (or perhaps because of mortgage regulations), Canada’s two leading mortgage broker firms are cleaning up. Dominion Lending Group posted a vigorous 30% growth rate and $8.4 billion of closed mortgages in the first quarter. Meanwhile, Rival M3 Mortgage Group announced it closed 32% more deals and $9.3 billion in Q1. M3’s EVP Dino Di Pancrazio said:“Our brokers are less reliant of walk-in traffic and most are used to doing business at a distance.” They’re also used to “advising customers in many different financial situations and I think that this became increasingly valuable as some people saw their salaries cut or lost their jobs. Of course, once real estate was shut down that pretty much shut the door on new deals, but that happened in March for the most part…”

- One Less Tax Grab: Manitoba will no longer require insured borrowers to pay PST, effective July 1. Go, Manitoba!

Mortgage Report May 29, 2020

- Now in the 3s: For the first time ever, a Canadian reverse mortgage provider has a 5-year fixed term under 4%. Equitable Bank announced the offer Thursday, which applies to its 5-year “Lump-sum” reverse mortgage. Equitable trimmed all of its other reverse mortgage rates by 15 bps as well. That’s a big win for cash-strapped seniors needing to cash out home equity. It also puts more pressure on the lead dog, HomeEquity Bank, founder of the CHIP reverse mortgage. Equitable’s 5-year Lump-sum product is now a whopping 150 bps below a 5-year CHIP, albeit HomeEquity offers bigger loan amounts under normal circumstances. A regular CHIP or Equitable Bank reverse mortgage also has another advantage. It lets you borrow over time so interest is calculate on a smaller balance. Equitable’s 3.99% Lump-sum product makes you borrow all at once. But, with such a head start on the rate, it’s worth giving up borrowing flexibility for interest savings, if you truly need all of the funds upfront.

- Bank of Canada Predictions: Here’s what the tea leaf readers are expecting at next Wednesday’s BoC rate meeting. (Rates.ca story)

- Should You Convert? We hear from many in floating rates who want to know if they should lock in (convert) to a fixed rate. Most of the time, what they’re really asking is, are rates going up in the near future? We won’t answer that question because guesswork is guesswork, but here’s what we can say for sure. People usually lock in their variable because they:

- Find a low fixed rate that seems too good to turn down

- We’ll see more conversions once 5-year fixed rates are commonly below 2%, for example.

- Fear higher rates will leave them with too little cash flow each month

- Note: This is mainly a problem with adjustable-rate mortgages where the payment moves with prime rate. By comparison, variable mortgages offer fixed payments, which mitigates this issue.

- No longer want the stress of worrying about rising rates.

- Find a low fixed rate that seems too good to turn down

All of these can be valid reasons to lock in, depending on the circumstances. But if you’re going to convert, make sure it’s worth it. Determine what conversion rate your lender will offer. Any 5-year fixed over 2.64% right now is weak. Then determine the spread or difference between that and your variable rate. The bigger the spread (e.g., > 1.00%-point), the less likely you’ll win by locking in.

- Last Resort: Desjardins says negative interest rates are now viewed by the BoC as “a desperate measure.” In other words, don’t bank on life below zero unless the wheels really come off the economy. And, no, apparently an unemployment rate exceeding all others since the Great Depression isn’t bad enough. Indeed, let’s hope that the recovery is robust because, unless rates rise 250+ bps someday, the BoC may have insufficient rate cutting room to address future crises. In any event, we may have to wait until the next recession to see negative rates—but they’ll get here in due time.

- RE/MAX v. CMHC: CMHC’s 18% price drop prediction “is panic-inducing and irresponsible,” says a RE/MAX executive. Makes you wonder what he’d say if CMHC predicted an 18% increase in home prices. CMHC’s CEO Evan Siddall fired back, saying: “Please question the motivation of anyone who wants you to believe prices will go up (yes, up) with our economy in slow motion, oil being given away, millions of Canadians on income support and a greater percentage of mortgages not being paid than we’ve seen since the Great Depression.” (Thinkpol story)

- Mortgage Investment Corps: “For those investors locked up in one of these funds, the future of your money is now out of your hands…” (Wealth Professional story)

- COVID Entrenches Online Banking: Mobile banking registrations soared 200% in April. “…Only 40% of respondents said they expect to return to branches post-COVID, indicating the shift to online is likely to stick.” (CNBC story)

Mortgage Report May 26, 2020

- Decade Discounts: With rates near perma-lows, according to some, people aren’t exactly lining up to lock in for 10 years. That’s especially true with penalties being so large on 10-year fixed terms, that is, until a mortgage passes its five-year anniversary—at which point the Interest Act limits penalties to three months’ interest. Nevertheless, effective rates on 10-year fixed mortgages just hit a record low yesterday, according to our records. The cheapest 10-year is now just UNDER 3%. There are (aren’t they always) restrictions. The offer applies to all loan-to-values and all deal types (purchase, switch or refinances). The property must be owner-occupied and located in Ontario.

- Best-Case Scenario: If you’re in the mood for good news, Bank of Canada Governor Stephen Poloz delivered today. He said the best-case scenario for Canada’s economic recovery is still the “most likely scenario.” But he cautioned, “significant” monetary stimulus will be needed to rebuild jobs and spending. That’s essential to keep inflation near-target, given that deflation and high debt loads are the “two main ingredients of depressions…”

- Don’t Tinker, Says NBC: “Now is not the time to tinker with mortgage rules,” write National Bank analysts. “Introducing more restrictive underwriting criteria at this time is likely to add further stress to a housing market that is experiencing a significant slowdown…It could exacerbate house price declines that negatively impact the broader economy through wealth effects, not to mention rising losses [for lenders and default insurers].”

- Mini-Rebound: Home sales picked up “notably” in the first half of May, says CIBC. That follows plummeting sales and listings in April, as the following chart from CIBC shows. The bank’s economists expect disproportionate demand for less expensive housing types in the weeks ahead. That “compositional effect” is pulling down average sale prices faster than normal.

- Favourable Rate Resets: Tens of thousands of borrowers stand to save when their mortgage renews next. In the same report as above, CIBC Economics says, “…The weighted average mortgage rate currently paid by borrowers [is] roughly 50 basis points higher than the current rate…” It shared these other insights as well:

- “…Lower-income borrowers are participating in [mortgage deferrals] at a higher rate…” (no surprise)

- Landlords report a “better-than-expected” 9 out of 10 renters are paying their rent. (a surprise)

- Only 18% of jobs lost since February were full-time “high paying” jobs.

- Status Quo: RBC said today it sees no significant change in monetary policy near-term, once incoming Governor Tiff Macklem takes control of the Bank of Canada next week. Macklem’s first rate decision as BoC chief comes Wednesday, June 3.

- Quotable: “It’s probably not going to be a quick, sharp V-shaped type of recovery that people were expecting initially.”—George Davis, RBC Capital Markets’ chief technical strategist (Financial Post)

Mortgage Report May 25, 2020

- Less Stress: The minimum “stress test” rate is officially dropping to 4.94%. That’ll make it slightly easier to qualify for a mortgage if your debt ratios are near the allowable limits. The new stress test rate takes effect Monday, May 25 for default-insured mortgages. For uninsured mortgages, “Lenders are free to use the updated figure as soon as it is published,” says banking regulator OSFI. (It’s now published.) “However, for operational reasons, lenders may opt to update their systems on Monday to align the effective date for the insured space.”

- RBC on Higher Down Payments: In follow-up to Evan Siddall’s comments yesterday and speculation about minimum down payments rising, RBC said: “CMHC acts as an adviser to the DoF and in our opinion, Mr. Siddall’s views are respected within Ottawa. As a result, we think there is a reasonable chance that higher minimum down payments may happen, but if it does, the magnitude and timing are unclear, especially since any change might further weaken the economy or at the very least is likely to prolong a recovery in housing market activity…”

- Monitoring Deferrals on Credit Reports: Free credit score provider Borrowell has a new feature for people who’ve deferred their mortgage payments. It tells you if your mortgage lender is improperly reporting deferred payments as delinquent to the credit bureau Equifax. “Late payments typically account for 35% of credit scoring models,” Borrowell says. And—as we know too well—creditors make mistakes on credit reports, so it’s not a bad feature. Details…

- Computing Penalties: Here’s an updated list of mortgage penalty calculators from popular lenders.

- Prolonged Recovery: Fed Chair Jerome Powell worried people on Sunday when he said the recovery could “stretch through the end of next year.” And today we learned that the Fed projects a material chance of a second wave of the coronavirus late this year. Rate Impact: Potentially Bearish

- Oil Rally: Oil prices are the highest they’ve been in over two months. WTI spot crude is now $71 above its all-time low of -$37.63 (yep, that’s a minus sign), which was set just one month ago. Rate Impact: Bullish

- Deflated Inflation: Prices for many items (particularly clothing and transportation) sank in April. Yet, an average of the core inflation measures preferred by the Bank of Canada showed little change (down just 0.03%) because of how they’re calculated. For the time being, rising oil prices could further stem inflation’s slide. Rate Impact: Neutral

Mortgage Report bonus…..

- 5% Down Payments at Risk? Canada’s housing agency says it must “avoid exposing young people” and “taxpayers” to “amplified losses that result from falling house prices.” CMHC CEO Evan Siddall said today, “Unless we act, a first-time homebuyer purchasing a $300,000 home with a 5% down payment stands to lose over $45,000 on their $15,000 investment if prices fall just 10%, which we are forecasting.” CMHC says its calculations include the mortgage insurance premium and the costs of selling the home if forced to do so because of unemployment or any other reason. “In comparison, a 10% down payment offers more of a cushion against possible losses…We are therefore evaluating whether we should change our underwriting policies in light of developing market conditions.”

- What it Could Mean: Some will take Siddall’s comments to mean the days of 5% down payments are numbered. Siddall told Parliament’s Standing Committee on Finance that, “We’re talking to our board of directors this week…we may restrict the business we do in the short run.” But Siddall tells us that “We have made no decisions” with respect to down payments, and reminds us that down payment increases on insured mortgages would be the Minister of Finance’s purview, not CMHC’s. And “there’s no talk of that [e.g., 10% minimum down payments across the board] right now.” Indeed, a 10% minimum down payment would protect borrowers, but it would also be pro-cyclical, meaning it could remove demand from a weak market and accelerate price declines. That’s why Siddall adds, “We need to be careful not to act precipitously” and he stresses that “We expect any economic slowdown to be temporary.” CMHC is projecting a rebound in housing to pre-COVID levels by sometime in 2022.

- There are Still Two Other Insurers: It’s possible that one or both of CMHC’s two private competitors could continue insuring mortgages in market segments that CMHC pulls back on.

- But Wait There’s More: Here’s what else Siddall said that will raise concern:

- “CMHC is now forecasting a decline in average house prices of 9 – 18% in the coming 12 months…There will be greater declines in oil-producing regions (Alberta, Saskatchewan and Newfoundland) and in places where house prices got ahead of themselves (Toronto and Vancouver).”

- “Something like 2% of insured mortgages could experience losses,” he says, stressing that forecasting with accuracy is almost impossible given so many unknowns.

- “Trees don’t grow to the sky…The musical chairs game [with housing] is going to come to an end…and young people, who are very highly leveraged [could suffer].”

- CMHC says almost 20% of mortgagors will have requested mortgage payment deferrals by September.

- The housing agency is planning for a “growing debt ‘deferral cliff’ in the fall,” Siddall says. At that time, deferrals are expected to end and many unemployed Canadians won’t be able to make their mortgage payments.

- Ultimately, “As much as one-fifth of all mortgages could be in arrears if our economy has not recovered sufficiently,” he warns.

- Debt-to-GDP ratios above 80% tend to intensify “the drag on GDP growth,” he stated, and Canada’s could reach 130% by Q3 before declining somewhat.

- The more commonly cited debt-to-disposable income measure will climb from 176% (and we thought that was high) to as much as “230%…through 2021,” depending on how much GDP falls.

- “Canadians do a very good job of paying their mortgages even when they’re underwater.”

- Economic Perspective: Canada’s economy will plunge 41.3% annualized in the second quarter, according to the average analyst surveyed by Bloomberg. That’s an utterly unfathomable number — one that’s never been equalled in a single quarter. So, given that mass unemployment trumps tight supply, low interest rates and other bullish housing factors, CMHC has ample reason for concern. It seems highly likely that Canada’s top default insurer will suspend some mortgage programs and/or tighten qualifying rules in the weeks ahead.

Mortgage Report May 20, 2020

- Now to 4.94%: Scotiabank trimmed its posted 5-year fixed rate to 4.94% on Saturday. That puts the mode average of the Big 6 Banks’ 5-year posted rates—and hence the minimum stress test rate—at 4.94%. Of note:

- This is the lowest the stress test rate has been since October 2017

- The all-time low was 4.64%, last seen almost three years ago (July 2017)

- Compared to last week, it will now take about 0.8% less income ($102,150 total) to afford the average-priced ($488,203) home in Canada, assuming 5% down, a 25-year amortization and no other debts.

- But, the drop in the average home price since March—by itself—lowers the minimum required income much more, by 10.3%. It also reduces the minimum required down payment on that average home, from 5.39% ($29,198) to 5.00% ($24,410).

- Scotia’s Other Rate Drops: Scotiabank lowered these other posted rates as well:

- 1yr: 3.44% to 3.19%

- 2yr: 3.54% to 3.29%

- 3yr: 4.19% to 3.89%

- 4yr: 4.39% to 4.19%

- 5yr: 4.99% to 4.94%

- 5yr variable: 3.05% to 2.65% (Prime + .20)The short-term posted reductions are mainly relevant because they increase prepayment penalties for many customers who are breaking their mortgages early. That’s due to how banks calculate prepayment charges.

Mortgage Report May 19, 2020

- Prices Tumble in April: The national average home price in Canada has plunged almost 10% in one month (April). That’s never happened before in CREA data going back to 1980. The next closest month-over-month drop was -7.6% in April 1989. The data was skewed partly by the GTA’s 11.8% nose-dive.

- Home Inventories Skyrocket: The total number of real estate listings, relative to sales, exploded 111% last month. Canada is now at 9.16 months of inventory (seasonally adjusted), says CREA. In other words, it would take over nine months to clear all listings at the current pace of sales. This is the highest level of inventory since the 2009 recession when it peaked at 9.71 months. Inventory is the most telling of CREA’s housing indicators. Sudden spikes are often followed by further price weakness in ensuing months.

- Some Perspective: During past recessions, like in the early 1990s, real estate “listings were piling up,” CREA Senior Economist Shaun Cathcart tells us. “Right now, they’re falling fast.” He adds that sales “disappeared instantly” after the lockdown, yet most listings “hung around,” even though many sellers didn’t (couldn’t) actively market their properties. “I expect [months of inventory] to fall back next month,” Cathcart projects.

- BMO’s Insured-Rate Gap: Banks are being more aggressive with their advertised default-insured mortgage rates. As BMO’s move below shows, it’s “rewarding” insured borrowers with 30-bps lower rates. That 3/10th of a point savings means an insured BMO borrower pays $1,400 less interest per $100,000 of mortgage over five years. But they have to pay up to a 4%+ insurance premium to get this lower rate, depending on their equity.

- Side note: If you’re wed to your bank for some reason—and you have a 65% loan-to-value or less—it may be worth asking what rate the bank would give you if you paid the $600 per $100,000 CMHC fee. If the insured rate is more than 15 bps lower than the bank’s best uninsured rate, you may be ahead. Of course, you’ll usually find a lower rate at another lender with no insurance premium required.

- These are BMO’s latest fixed-rate reductions:

- 3yr “Special”: 2.89% to 2.74%

- 5yr Smart Fixed (insured): 2.79% to 2.69%

- 5yr Smart Fixed (uninsured): 3.09% to 2.99%

- CIBC Trims Fixed Rates: Canada’s fifth biggest bank lowered the following advertised rate “specials” today:

- 5yr: 3.09% to 2.97%

- 7yr: 3.29% to 3.17%

- National Bank Cut: …the following special fixed rates:

- 4yr: 3.04% to 2.94%

- 5yr: 3.09% to 2.99%

- Down Payment Primer: Here’s a quick overview on how to prove your down payment to lenders.

- Credit Taps Tighten for Investors: When loan losses mount, credit policies get conservative. Here’s a story on how one bank has started prohibiting HELOCs as a source of rental property down payments. “There have been thousands of real estate investors buying negative cash flow properties, specifically condo investments where their monthly costs far exceed their monthly income on those properties and that is a very real source of concern,” says Broker Calum Ross.

- China vs. USA II: Four months after signing a much-ballyhooed trade deal, U.S./China relations are in the toilet. Trump threatened to “cut off the whole relationship” over suspicions about the “plague from China,” as he put it. Now China’s making its own threats. That, along with horrid economic numbers (e.g., retail data), could hurt market sentiment and push down bond yields. For how long is anyone’s guess, but the last Ameri-China trade spat lasted a year and a half. Analysts don’t expect this altercation to last that long. Rate impact: Bearish

- Grim Harbinger: 1 in 4 Canadian restaurants will never re-open, according to Ipsos estimates. That is consistent with U.S. surveys. The mortgage relevance here is the sheer fact that businesses of all sorts are simply going to disappear post-COVID. All this talk of a V-shaped recovery is distracting many from this truth. We’re likely looking at suppressed economic growth for years, not months (not including the immediate post-COVID bounceback — which is unlikely to get us back to where we were pre-COVID). Rate Impact: Bearish

- Capital Economics on Negative Rates: “The key issue is not that the policy rate is still too high, but that credit spreads are still elevated.” In other words, investors continue to force banks to pay more for funding, and that’s keeping loan rates higher than normal relative to bond yields. While negative rates in Canada may be inevitable someday, the BoC would likely buy more assets (e.g., buy bonds to push down longer-term rates, including mortgage rates) before it went negative on its overnight rate.

- Loss Provisions Soaring: Lenders are setting aside far more capital for expected losses than Bay Street anticipated. Equitable Bank was one canary in the coal mine this week. Its provisions for uninsured mortgage losses were 48 bps vs. its 9-bps long-term average. Home Capital, too, surprised observers by increasing its provisions to 70 bps in Q1, up from 9 bps in the previous quarter. Capital isn’t free. These loan-loss buffers will probably result in higher-than-normal mortgage rates (relative to bond yields) for multiple quarters.

- Steer Clear for Now: “Banks stocks [are] unlikely to outperform until signs of credit losses are peaking,” says National Bank Financial. And it’s “still too early to make that call.”

- FTHBI Bust: The “2,950 [First-Time Home Buyer Incentive] approvals are a far cry from the target of 20,000 that CMHC had set for the program’s first six months of operation.”—MP Tom Kmiec via MBN

- Fun Fact: Or, not so fun if you’re anti-oligopoly. “The largest five banks hold 89% of the market share [in Canada], compared to 35% in the US,” notes Capital Economics.

Mortgage Report – May 14

- De-Stressing: Call out the marching band, BMO’s posted 5-year rate cut today should ease the government’s mortgage “stress test,” effective next week. As it stands, the minimum stress test rate will likely fall from today’s 5.04% to 4.99%. It’ll mark the first time since January 2018 (when OSFI’s stress test began) that this benchmark rate has been under 5%. And, if one more bank matches BMO’s and RBC’s 4.94%, it could drop another 5 basis points. A 5-bps lower stress-test rate won’t get you that mansion in West Vancouver, but it’s something. If it does go to 4.99%, a household making $100,000 a year with 5% down and no other debt can afford about a $2,000 bigger mortgage, versus today.

- BMO’s Other Rate Drops: Here are all of its posted-rate changes today:

- 1yr: 3.29% to 3.09%

- 2yr: 3.54% to 3.39%

- 3yr: 4.05% to 3.89%

- 4yr: 4.64% to 4.34%

- 5yr: 5.04% to 4.94%

- 5yr variable: 2.95% to 2.45% (Prime)

- TD Cuts: TD did a little rate cutting too, this time to its advertised “Special” fixed rates:

- 3yr: 2.89% to 2.74%

- 5yr: 3.09% to 2.97%

- 5yr (high ratio): 2.79% to 2.69%

- For Those Who Were Wondering: This one sentence from today’s Bank of Canada Financial System Review is the main reason why advertised bank mortgage rates are still inflated: “…Bank funding spreads and mortgage interest rate spreads are higher than they were before COVID‑19.”

- 1-in-5 Mortgagors Have Little Safety Net: “About 20% of all mortgage borrowers do not have enough liquid assets to cover two months of mortgage payments,” the BoC estimates.

- Debt Ratios to Climb: “The proportion of households with debt-service payments of more than 40% of their income, an indicator of household vulnerability, is likely to rise.”—BoC

- Arrears to Rise: If the Bank of Canada’s “pessimistic” scenario (its words) plays out, the percentage of people 90+ days behind on their mortgage will peak in Q3 2021 at 0.8%, well above most economist forecasts. The highest arrears rate in CBA records back to 1990 has been 0.65%. The Bank estimates it would have shot up to 2.11% had lenders not agreed to payment deferrals.

- Our Banks are Solid, But…: “…The country’s banking system and financial market infrastructures are strong enough to deal with [the pandemic]—and even the more severe economic scenario that we outlined in last month’s MPR,” says BoC Governor Stephen Poloz. But, “…The pandemic remains a massive economic and financial challenge, possibly the largest of our lifetimes, and it will leave higher levels of debt in its wake.”

- Timing the Bounce-Back: The time frame for a housing rebound is “uncertain” and price expectations have softened “quite a lot,” said Deputy BoC Governor Carolyn Wilkins today, but it will “firm over time.” Clearly. The question is whether to characterize the rebound time in months, quarters, years or a decade+. Likely not the latter, say the trusty econo-scientists in the banking and real estate sectors.

- Prolonged Pain: Hundreds of thousands of North American businesses will never again re-open post-COVID. That’s partly why Fed Chair Jerome Powell warned yesterday of the “significant downside risks” of a sustained recession following the pandemic. There are reasons why bond yields haven’t been zooming like stock prices, and this is one of them. Rate impact: Bearish

- Powell: Spend More: The Fed chief urged Congress to take even more extraordinary measures to prop up the economy (i.e., deficit spend). That sent shivers up the spines of deficit hawks who fear that gobs of money creation will stoke inflation and perma-deficits will boost the credit risk premium built into so-called “risk-free” government bonds. Rate impact: Potentially bullish…someday

- The Don Wants – 0.25%: Yesterday, Trump once again goaded the Fed on Twitter to go sub-zero with its policy rate. The Fed’s Powell politely declined, saying, “This is not something that we’re looking at.” Rate Impact: Slightly bearish (the Donald usually gets his way)

Mortgage Report for May 13, 2020

- Not So Timely: The government’s 5-year bond yield, which heavily influences fixed mortgage rates, peaked in October 2018. Since then, it has collapsed 212 basis points. Meanwhile, big banks have lowered 5-year posted rates just a stingy 30 basis points. The banking regulator (OSFI) considers that a problem and proposed to de-link the mortgage stress test from posted bank rates as a result. Well, RBC did “its part” Tuesday to narrow the gap. It cut its posted 5-year fixed rate by 10 whole basis points, to 4.94%. That puts it at the lowest point since October 2017 and makes it the lowest 5-year posted rate among the Big 6 banks.

- Who Cares? RBC’s posted-rate cut has dual relevance:

1) As noted, the Big banks’ posted 5-year rates determine the government’s mortgage stress test. If one more bank lowers its current 5.04% rate, the minimum stress test rate could drop, making it easier for borrowers to qualify for a mortgage. Will this happen? Yes. We just don’t know when exactly.

2) Other things equal, a lower 5-year posted rate reduces interest rate differentials (IRDs), and hence prepayment penalties. That can potentially save borrowers money if they break a big-bank 5-year fixed mortgage early.

We say “other things equal,” however, because RBC also cut its shorter-term posted fixed rates. That can have the opposite effect; i.e., it can widen IRDs and increase penalties for existing borrowers who break early. Here’s the full list of RBC’s posted fixed-rate reductions:- 6mo convertible: 3.29% to 3.04%

- 1yr: 3.19% to 3.04%

- 2yr: 3.54% to 3.39%

- 3yr: 4.05% to 3.90%

- 4yr: 4.64% to 4.44%

- 5yr: 5.04% to 4.94%

- Economic Cheat Sheet: As we parse economic events, some readers find it hard to infer how such events could impact mortgage rates. So, going forward we’re adding a bit of help. Effective today, the Spy will make an attempt to gauge the impact of economic news on mortgage rates in a clearer way. We’ll do that with a quick summary in italics following economic news blurbs. Projected rate impacts will be labelled:

- “bearish” (i.e., the news could push rates down over time, other things equal)

- “bullish” (i.e., the news could push rates up over time, other things equal), or

- “minimal” (i.e., the news may have imperceptible impact on mortgage rates).

In reality, things are never “equal.” And, more importantly, the time frames for economic developments are impossible to speculate on, so we won’t. Specific economic predictions are a fool’s errand anyhow. That said, the hope is that such commentary might help readers who are adamant about forming a mental picture of how rates might play out.

- Oil Panic Over, For Now: Just 22 days after traders couldn’t give a barrel of oil away (literally), the oil pendulum has swung towards fears of under-supply. Funny how that works. That’s got WTI oil trading near a one-month high. But, notice how oil’s 258% rebound since April 21 hasn’t budged one of Canada’s most important economic indicators, the 5-year government bond yield. Traders aren’t buying the energy turnaround story, and oil’s short-term bounce is barely impacting the long-term inflation outlook. Rate impact: somewhat bearish.

Data is expressed as indices so you can see the relative percentage changes.

- Trade Tensions Return: As if we need another cloud hanging over the economy, Washington’s denunciation of China’s handling of COVID risks jeopardizing trade progress between the two countries. Beijing showed what it can do this week by banning certain Australian meat imports, accusing the Aussies of spearheading a “malicious campaign to frame and incriminate them.” Now, with China also accusing the U.S. of a smear campaign, optimism on U.S./China trade is at a multi-month low. And yes, if things get frosty trade-wise, Canada won’t escape harm given its U.S. economic ties. Rate Impact: slightly bearish.

Mortgage Report for May 12, 2020

- Hitting Triples: Borrowers would love to see 5-year fixed rates under 2% and eventually they’ll get there. But for now, banks are “reducing mortgage rate discounts to conserve profitability,” as Deloitte put it in a recent report. Alas, we’ll have to make do with the historically low rates we already have. And for all you fixed-rate fans, the lowest fixed rate in Canada is now the triple-year (3-year) fixed at 2.09% or less. (Forgive the baseball reference. We miss MLB.) As is so often the case with the lowest rates, however, restrictions apply. This deal is available only to default-insured homebuyers or those with 35%+ down. If that matches your financing needs and you’re well-qualified and risk-tolerant, it’s worth a look. A 3-year fixed is more flexible than a longer term because it lets you refinance sooner (or discharge your mortgage sooner) with no prepayment penalty. The typical mortgagor renegotiates or discharges in roughly 3.7 years. And, for market bears who don’t think Canada will see above-target inflation in the next 33 months, a 3-year at 2.09% gives you Canada’s lowest fixed rate with no upside rate risk until mid-2023. At that time you can renew into any term you want, including a deep-discount variable, if they’re available by then (they should be). By the way, we say “33 months” because you can usually lock in great rates on your next term 90 days before your maturity date.

- Five Years for 2.14%: HSBC’s default insured 5-year fixed at 2.14% remains the most-inquired-about rate for the second straight week. At just 5-6 bps more than the lowest fixed rate (noted above), it’s attracting a flood of interest. Several competing lenders could match this rate as profit margins support it. But, curiously, they’re not. Competitors apparently don’t believe they’ll lose enough business to HSBC’s leading discounts. Or perhaps they think people will pay extra to avoid HSBC’s potentially high big-bank-style prepayment charge.

- Banks Still Paying More: Big 6 Banks are still paying 35+ basis points more than normal to fund 5-year debt. That premium raises their “weighted average cost of funds,” which often leads banks to charge more for mortgages. Were funding costs more “normal” right now, we’d already be seeing 5-year fixed rates under 2%. To break that 2% floor, it’s likely that either:

- base funding costs (as measured by bond yields or swap rates) must drop, or

- the risk/liquidity premiums banks are forced to pay must drop. One or both could very well happen by the end of this year.

- Forward Thinking: The market thinks 5-year rates will be higher in five years, about 40 bps higher based on 5-year forward contracts. These forward contracts essentially let traders bet on where rates will be in the future — in this case, in 2025. A few months ago, the market was pricing in no change in 5-year rates through 2025. BoC rate cuts and government relief measures changed that thinking mighty quick. Forwards are volatile instruments and not the most reliable mortgage selection tools, but they do provide an instructive reminder that rates can go up following economic downturns.

- COVID Disloyalty: In a report this month, Deloitte says the coronavirus crisis is “likely” to encourage more switching of lenders “than ever before” as borrowers “face challenges getting banks to respond to their needs quickly and effectively.” Hence, not only will COVID cost unresponsive lenders mortgage originations today, but it’ll cost them renewals in the future.

- Deferral Modelling: Another nugget in Deloitte’s report was that banks are analyzing which borrowers have requested mortgage deferrals. The purpose for banks is to understand commonalities in these customers and “capture the risk that is not inherent in [traditional] credit scoring models,” Deloitte explains. Banks will apply that knowledge in future underwriting decisions to manage their risk and adjust mortgage pricing. That means customers with a higher probability of requesting a mortgage deferral (those in higher-risk industries) might pay slightly higher mortgage rates.

- CERB Kills Mortgage Approvals: Shady mortgage applicants underestimate lender due diligence. We heard from a broker this weekend about a mortgage applicant who told his lender he was working. The lender then noticed a $2,000 CERB deposit in the client’s bank account. It told the broker it was cancelling the mortgage approval since the client was either committing tax fraud or lying about their employment status. Mortgage applicants who get laid off, have their hours cut back or apply for government assistance before their mortgage closes should expect disappointment if they try to pull the wool over lenders’ eyes.

Daily Mortgage Report for May 8, 2020

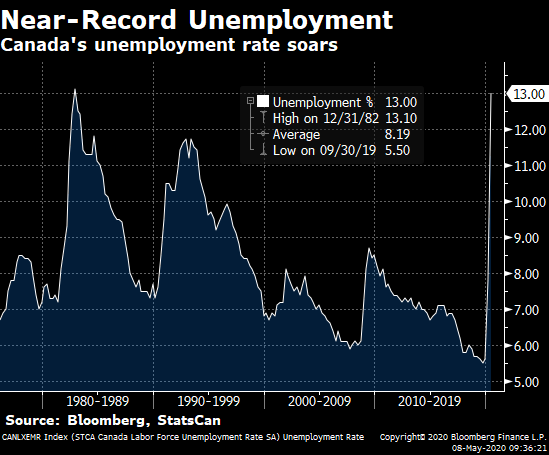

- Unemployment Surprise: Unemployment is a key determinant of home prices. And while it may seem hard to put a record 2 million lost jobs (StatsCan’s estimate for April) in a positive light, when economists were predicting double that amount, it’s a relief. Canada’s unemployment rate surged to 13%, near the highest in modern data going back to the 1960s (it was ~30% during the depression). And while 2 million was less than we and others feared, “more than one-third (36.7%) of the potential labour force did not work or worked less than half of their usual hours,” said StatsCan.

- Record Government Support: 7.6 million Canadians have applied for the $2,000/month Canada Emergency Response Benefit (CREB). The government’s hope is that CREB, combined with mortgage/rent deferrals and other extraordinary government subsidies, might get Canada through double-digit unemployment better than in 1982, an era with 20%+ interest rates— albeit far smaller debt loads.

Daily Mortgage Report for May 7, 2020

- A Record 4 million: That’s how many jobs disappeared in April, predict economists surveyed by Bloomberg. That’s a stunning one-fifth of the labour force, and only a portion of those jobs will return soon. How many of these families own homes? A meaningful minority. But the bigger question is, how many will continue paying their mortgage after September if/when payment deferrals end? Many believe deferrals will have to be extended. Banks aren’t thrilled by that prospect but most would comply if prodded by the feds. It’s the smaller, less capitalized lenders that simply can’t keep deferring and could be in trouble.

- This Yield Curve Godfather: Says the yield curve is “a leading indicator, and it’s saying that we’re coming out of recession.” That’s the good news. The bad news is that “coming out” could take 1 to 2+ years.

- Free Credit Report: Equifax Canada is offering free online credit reports for the first time ever. Link

- Norwegian Omen?: Floating-rate borrowers want to know if Canada will cut its key lending rate again. If Norway—a country also heavily dependent on oil—is any indication, there’s a real chance. Norway surprised 90% of economists today (according to Bloomberg’s survey) by cutting its policy rate to zero for the first time ever. Like Canada, Norway’s central bank has previously warned about the damage a 0% rate could do to the financial sector.

- Sub-zero U.S. Rates: South of the border, Fed funds futures imply negative rates by the end of this year. That would make The Donald do cartwheels, and thus far he’s got what he’s wanted from the Fed. If the Americans do go negative, Canada will be under pressure to follow, regardless of BoC messaging to the contrary.

- The Oracle on Negative Rates: Expect “extreme consequences.”

- Quotable: “…We anticipate the gap between listings and sales to grow in the coming months, as financial stresses force some homeowners to list their properties.”—TD

- Montreal Prices Dip Slightly: The city’s median single-family home price fell 1.4% in April, versus March.

- Commercial Financing Freeze: “…Owners who are unable to sell their properties are refinancing with alternative lenders at higher rates,” reports Reuters (via Yahoo! Finance). Expect commercial lenders to boost rates as demand grows and adjust LTVs lower to reflect valuation risk — not a good combination for income property investors on the ropes.

- Too Soon: “We…believe it is too early to be buying [mortgage stocks]…We think a significant increase in loan losses is likely in [the second half of 2020].”—RBC Capital Markets

- Padding Loss Reserves: Lenders will all be setting aside more capital for expected losses. Home Capital, Canada’s biggest non-prime lender, surprised analysts by announcing $30 million in Q1 credit loss provisions, up almost 400% y/y. The Street had expected roughly $10 million. Why does this matter to Joe Borrower? Because lenders are less willing to price mortgages aggressively in the face of mounting losses.